Let’s address the elephant in the room; the misconceptions people have about what blockchain means in general. Simply put –

Blockchain ≠ Bitcoin

Bitcoin or Altcoins (bitcoin alternatives) are digital currencies, also called as ‘Cryptocurrencies’. These are a digital token that allows users to pay for goods and services. Blockchain is the technology that enables the transfer of these digital assets. Though the launch of Bitcoin was the reason behind the conception of Blockchain, this technology has much more to offer, the applications of which we would delve further into detail in our subsequent posts.

So the first question, what is blockchain?

“Blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value.”

– Don & Alex Tapscott, authors: Blockchain Revolution

Simply put, it’s a digital ledger. But unlike a bank/financial institution/governing body’s ledger, it is not centrally controlled but is distributed across a network. This distributed ledger shared across a peer-to-peer network, stores transaction data and balances as well as validates transactions.

In a typical everyday scenario, we keep our transaction data private, only sharing it with certain people close to us. In a public blockchain, the transactions in the ledger are open and public, but at the same time, users are pseudonymous (hidden). This means that though the record is public, the names of parties involved in the transaction are not, which is fundamentally revolutionizing.

Now, you might have these questions:

- What is a distributed ledger?

- How does it work?

- What are the different components of the network?

- Why is it so secure and immutable?

Let us try to answer these :

- Distributed ledger

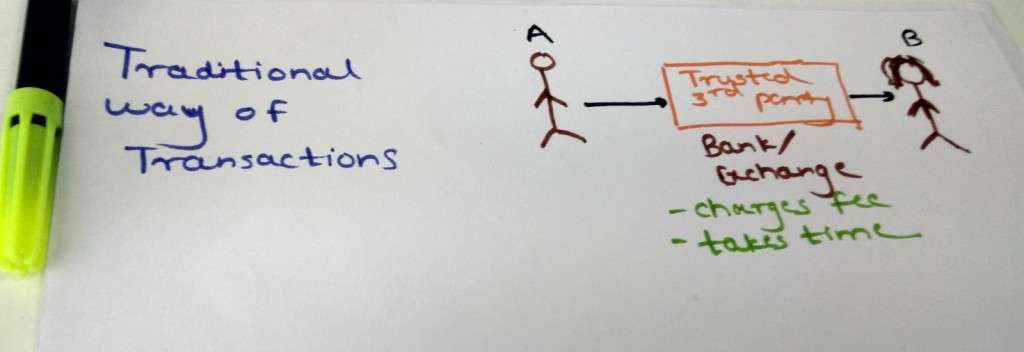

A distributed ledger allows the database of transactions to be available at multiple locations, unlike a traditional centralized database, where a central authority is involved. To illustrate this difference, let us look at the traditional method of a digital ledger –

Let’s consider an example wherein A wants to transfer $100 to B. Typically, A requests for the transfer through a bank which is a trusted third party overseeing this transaction. In return, bank verifies the credibility and charges some fee for conducting this operation.

From this example, we can recognize the following characteristics of Traditional Ledgers:

- Centralization: It has a central authority that governs the data and user access permissions, thus, ensuring security.

- Single point of Failure: If the governing authority is compromised, the database is exposed to huge risk and failure.

- Validity of transactions: The central authority is responsible for validation of all transactions, thus, being the only gatekeeper of trust.

Now, let us see how this process works from bitcoin’s perspective-

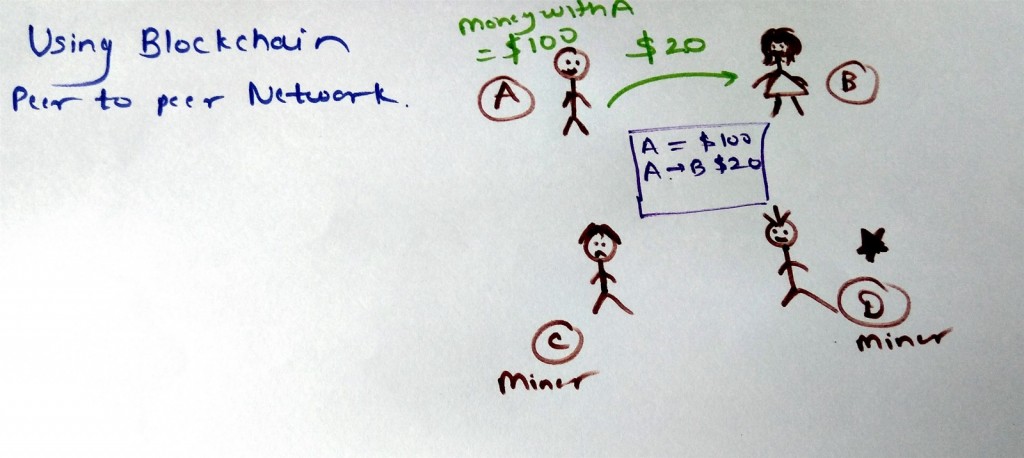

A Typical transaction in a peer to peer network

A Typical transaction in a peer to peer network

For ease of understanding, let us take an example of a 4 member peer-to-peer network, with no central authority. A has $100 and wants to transfer $20 to B. First, members of the network (either C and D) verify whether A has sufficient balance in his ledger. The digital ledger is present on everyone’s computer and the transaction gets updated in all the ledgers in the network. i.e., The transaction of $20, with A being left with $80 balance and B getting $20 gets updated on the network with each peer. (Our description here is simplified, we will talk more about roles like buyers/sellers/miners below)

From this we can derive the characteristics of Decentralized Blockchain Database:

- Open and Public: Everyone in the network has access to the ledger and transaction data as it’s stored at all nodes in the network. Hence, it is public and the information is easily accessible.

- Distributed risk: The power and access are distributed across all the participants in the network making it difficult for hackers to tamper with data.

Now let’s address the second question.

2. How does it work?

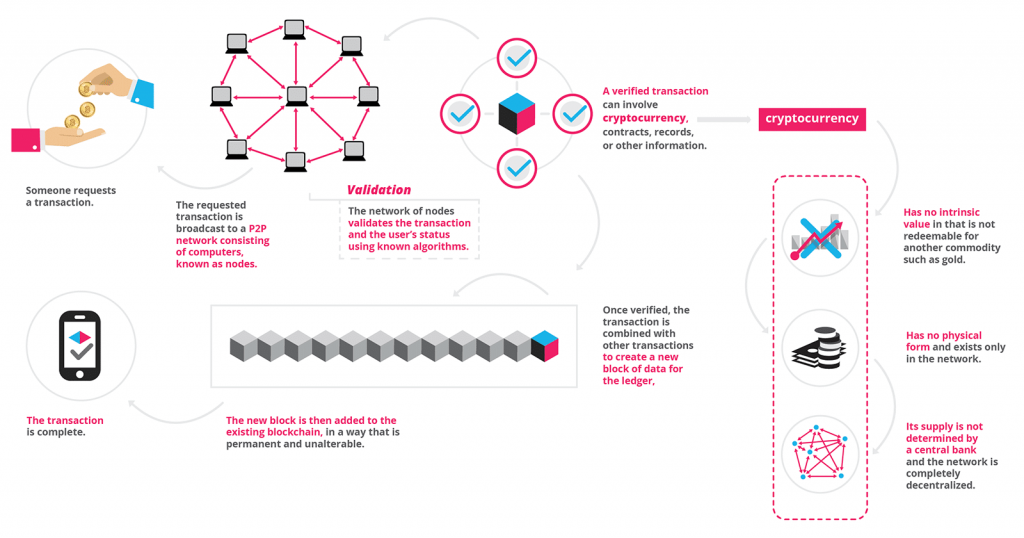

Here’s an infographic by Blockgeeks that explains the transaction flow-

Now, going deeper, let us take the same example as before –

- A wants to transfer $20 to B. (Same example from above)

- B announces this to the network. At this point, the transaction is not validated yet.

- C and D play the same role as above, i.e., they check A’s balance against the network ledger, authenticate the transaction at their nodes on the blockchain and progress it forward.

3. To validate the transaction, the concept of mining is being used. Let us look at the various components in this system-

- Buyer: This member bought some product/service from the seller, so is paying the seller. In our case, it is A.

- Seller: This member is selling his product/service. In this case, it is B. He is getting paid $20 from A for his product/service.

- Miners: Here, C and D are the miners. Miners are the members in the network who validate and establish the proof of work, by solving a mathematical problem. To solve this, they employ their computational resources. In mining, the person who solves this problem first gets a reward for investing his computational power for this transaction. In this case, let’s say D becomes successful in mining, so he publishes the hash value of the transaction, other peers in the network verify it and a block is added to the digital ledger at every node. This system rewards the first person to solve the problem.

- Consensus: Other members need to be on the same consensus after the update. Thus, tampering is prevented.

4. Why is it so secure and immutable?

The nature of blockchain is open, public and distributed across all the nodes. If one wants to verify any transaction details, then he/she can check all of the transactions all the way till genesis (first) block across all nodes. Hence any effort to tamper it would require changing all the subsequent data, present on every single node. This makes it more of a ‘system of record’ as compared to mere ‘database’. Also, adding any data in the blockchain needs a consensus from the peers in the network. Hence, it’s secure and immutable.

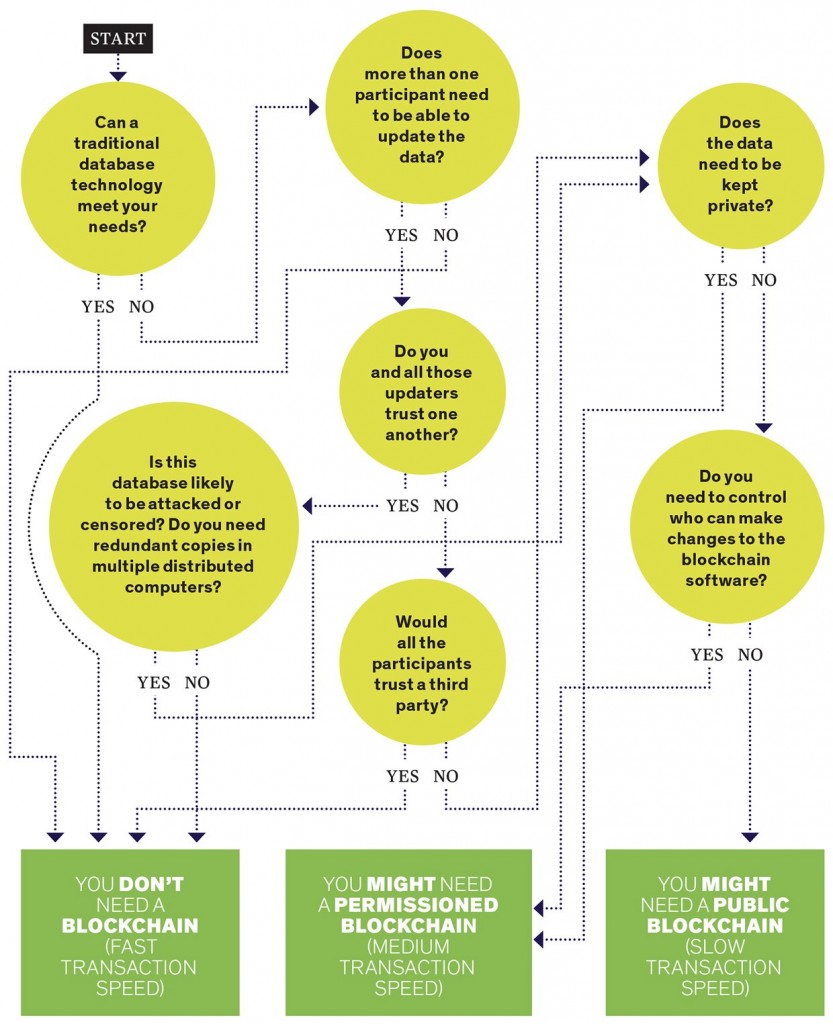

5. Do you really need blockchain?

This is perhaps the most important question. Before investing in the concept, you need to understand its merits and limitations. There are certain Decision Trees developed by multiple people and organizations to help you out.We will explore this direction in further detail in the next article of the series, looking into applications of blockchain. As an overview –